- About D-Link

- Products and Services

- ESG

Sustainable Development

Sustainable Supply Chain

Sustainable Workplace

For Stakeholders

- Investor Relations

- News Room

- Careers

Home > ESG > Governance > Climate Change Risk Management

Home > ESG > Governance > Climate Change Risk Management

Climate Change Risk Management

Home > ESG > Governance > Climate Change Risk Management

Climate Change Risk Management

Climate change poses an urgent challenge for all nations. D-Link has implemented the TCFD framework to assess climate-related risks and opportunities, analyze the financial implications of climate change, and develop governance and management strategies. We are committed to achieving net zero emissions and have developed diverse programs to mitigate climate change, preserve natural capital, and foster a sustainable future globally.

Implementation according to the TCFD framework

Governance

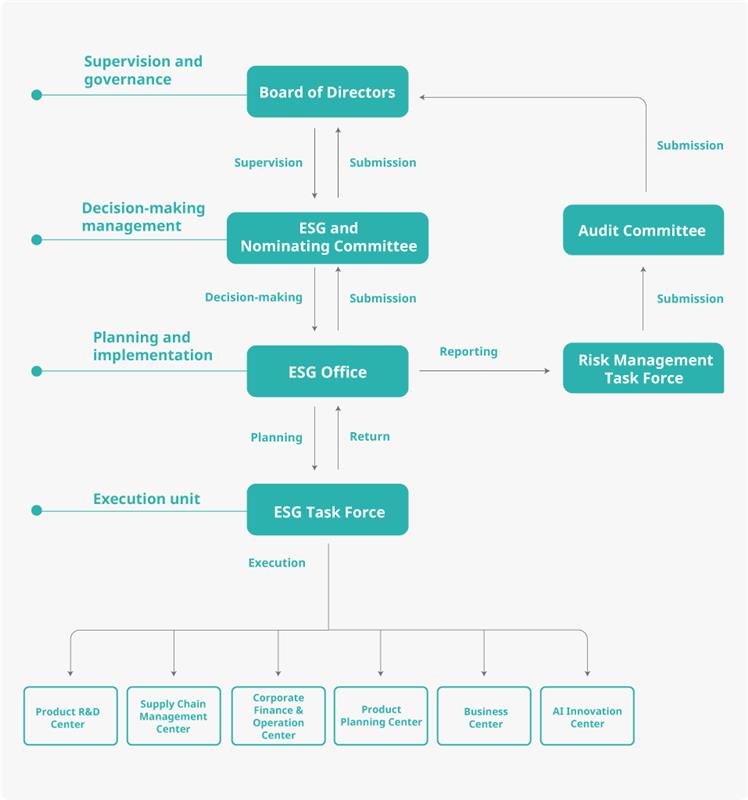

- Board of Directors: As the highest supervisory unit for climate change response management, it is responsible for reviewing relevant risk and opportunity management reports, response strategies, measures, and target implementation progress and results, ensuring the effectiveness of related management actions.

- ESG Committee: It is the decision-making and management unit for climate change response plans and target implementation progress.

- ESG Office: It falls under the ESG Committee and is responsible for further planning and promoting climate change response plans based on the climate risks and opportunities jointly assessed and identified with the ESG Task Force.

- The ESG Taskforce: Responsible for the related execution operations.

The ESG Office holds monthly ESG Task Force meetings to monitor the implementation status of the climate change response plans. It reports the implementation results, target progress, and follow-up plans to the ESG Committee and the Board of Directors on an annual basis, ensuring that the Board adequately supervises D-Link’s climate management actions and mitigates risk impact. Additionally, the ESG Office reports identified material climate risks to the Risk Management Task Force for evaluation of their incorporation into the Company’s overall risk management system.

D-Link Climate Governance Structure

Strategies

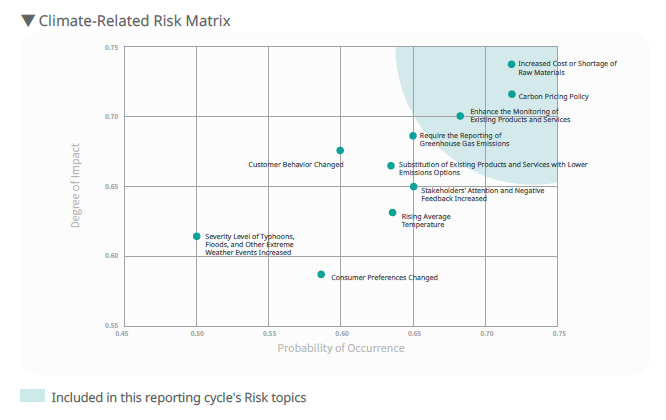

D-Link uses scenario analysis to examine the impact and estimated timing of future climate risks and opportunities on the Company’s operations, products and services, value chain, and R&D investments. This method allows the company to estimate the financial impact, explore business opportunities, and discuss countermeasures and response actions.

In terms of scenario setting, for transition risks, the Company evaluates the scenario of net zero by 2050 (SSP1-1.9), and for physical risks, it is estimated based on the high emission scenario (RCP 8.5) assuming business as usual (BAU). For the estimated time of occurrence, the Company defines short-term as within 3 years, medium-term as 4 to 10 years, and long-term as more than 10 years.

D-Link’s Climate Change Risk Matrix

Material Climate-related Risks

Type | Transition Risks - Market Trend | Increased Cost or Shortage of Raw Materials | Enhance the Monitoring of Existing Products and Services |

|---|---|---|---|

Climate-related Risks | Customer Behavior Changed | Increased Cost or Shortage of Raw Masterial | Enhance the Monitoring of Existing Products and Services |

Estimated Occurrence Time | Medium-term | Medium-term | Medium-term |

Risk Description | Due to the increasing awareness of global climate change and the impact of national policies, customers are relatively concerned about the low-carbon transformation progress of their suppliers, including energy management tracking, regular disclosure of annual carbon emissions data, and carbon reduction goals and strategies. Although for the current stage, the direct impact on orders is still quite limited, there is still a very small number of customers who require that the carbon reduction path planning must comply with the Company‘s carbon reduction commitments. We cannot rule out the possibility that it will become a condition for vendor selection in the short term; if failing to respond such in a timely manner, it may affect the business development. | Due to the demand for low-carbon transition of products, the use of recycled materials or materials with specific environmental labeling means an increase in invested costs, which may lead to a decreased price competitiveness. | As awareness of climate change grows, governments are increasingly focusing not only on corporate carbon emissions but also on emissions associated with products and services, particularly in regions with total emission caps such as the European Union. To mitigate the risk of carbon leakage, the Carbon Border Adjustment Mechanism (CBAM) has been established as a preventive measure. Under this mechanism, pricing is based on the carbon emissions per unit of imported products and their import volumes. According to regulations, if the carbon emission data of the product is not faithfully declared, or the declaration data do not meet the requirements, or the improvement is not made before the deadline, a fine of EUR 10 to 50 per metric ton will be imposed. Although D-Link products are currently not subject to the levy under the system, it is essential to continuously monitor relevant policy trends and make early preparations to respond. In addition, the EU officially effected the “Ecodesign for Sustainable Products Regulation2” in July 2024 to replace the previous ErP Directive3, emphasizing that enterprises must introduce the product life cycle assessments, including source design, durability, repairability, and recyclability requirements, to reduce environmental impacts. The enforcement of the regulations will bring more challenges to enterprises. |

Response Actions and Possible Financial Impact | Currently, D-Link has regularly checked the carbon emissions of the head office and branches in Taiwan every year, and has been verified by a third party. In addition, in accordance with the requirements of the “Sustainable Development Roadmap of TWSE / TPEx Listed Companies” and the “Sustainable Development Action Plan of TWSE / TPEx Listed Companies”, By the end of 2024, the Company has initiated the carbon inventory of its overseas subsidiaries. Once the data is obtained, the carbon reduction targets and corresponding implementation measures within this scope will be re-evaluated. Meanwhile, we are also promoting the plan to introduce carbon footprint to grasp the hotspots of product emission and further develop specific and feasible high-efficiency emission reduction measures. | The cost of PCR plastics is 10-15% higher than that of virgin plastics, which will lead to an increase in product costs. However, because the products to be introduced to appeal the special antenna designs and sustainable development concepts, D-Link AQUILA PRO AI Series Products will continue to do so in the future. In addition, the principle of using recycled materials as much as possible also includes product packaging. For packaging plastics that cannot be completely reduced in the short term, PCR plastics are also used. The cost is about 50% higher than that of virgin plastics. However, due to its low unit price, the impact on the total cost is quite limited. | Although D-Link products are currently not within the scope of CBAM, the potential future trend suggests that all products may eventually fall under CBAM. Recognizing that the EU CBAM has spurred countries to develop carbon tariff systems, prioritizing product carbon emission information will aid in collecting and extracting relevant declaration data. Additionally, given the rising market demand for low-carbon products, D-Link has decided to introduce the carbon footprint standard ISO 14067. This proactive step aims to facilitate future responses and align with market expectations. The introduction of the ISO 14067 standard and third-party verification expenses for a desktop switch product, for example, are estimated to cost approximately NT$1.2 million. Actual expenses may vary depending on the type and scale of products involved in the implementation. In the face of increasingly strict regulations, D-Link will continue to monitor the progress of regulations and implementation rules, to strive to create lower-carbon and more sustainable products to meet regulatory standards and market expectations. |

* For the complete list of climate-related risks and responses, please refer to D-Link’s 2024 Sustainability Report, pages P.112-114

D-Link’s Climate Change Opportunity Matrix

Material Climate-related Opportunities

Type | Products and Services | Resource Efficiency | Capital Markets |

|---|---|---|---|

Climate-related Opportunities | Develop and Increase Low-carbon Products & Services | Invest in Circular Economy | Low-carbon Financing /Investment |

Estimated Occurrence Time | Short-term | Medium-term | Medium-term |

Opportunities Description | Responding to the international carbon reduction trend, companies continue to invest in and expand the low-carbon product or service market, while confirming the market response. This action will enable the pioneer companies to more accurately grasp the pulse of the low-carbon market, create business opportunities, position for the market share, and indirectly increase the revenue and corporate image, to drive a positive cycle. | In addition to urging companies to focus on carbon emission management, extreme climate issues also require companies to pay more attention to the life cycle of the products and services they provide because of the trend of disclosure requirements in Scope 3, which will directly affect Scope 3 statistics. Therefore, at this stage, we are actively moving towards optimizing material usage, increasing the proportion of recycled materials, and exploring the expansion of multiple recycling channels to increase the end recycling rate. From a long-term perspective and the economies of scale related to future development, it is helpful for reducing the costs of procuring raw materials and establish a corporate image, among other positive benefits. | Governments around the world are actively directing funds to ESG and low-carbon products, such as bonds of sustainable development special funds or sustainabilitylinked bonds. In particular, the latter has no restrictions on the use of funds, only the sustainable development indicators are required to be set, and the goals to be linked to the design of bond principal and interest payment conditions and other mechanisms for acquisition, which can effectively reduce capital costs, improve sustainable performance, increase exposure, and attract the attention of more investment institutions. |

Response Actions and Possible Financial Impact | In order to more actively invest in the low-carbon market, D-Link launched the green packaging project, “D-Link Green Pack” , in early 2022, which focuses on four major aspects : environmental friendly materials, plastic-free packaging, volume optimization, and digitized product documents, as the pillars of design ; for example : • The unmanged switches adopts clay coated board3 with high percentage of recycled pulp, which can reduce costs by approximately 2–3%. • The plastic packaging bags are removed from Dongle series products. • Switch products adopts 50% PCR plastic bags for packaging, increasing costs by approximately 50%. • 30% PCR recycled materials are introduced to the plastic casings of the AQUILA PRO AI series products, MS30, MS60, M60, M95 and R95, and the costs are 10–15% higher than the virgin materials. • Brown boxes of DGS-1210-10MP and carton adopt FSC4certified paper materials. • The metal casing of the DMS-1250 series products is expected to have recycled metal introduced. | The Company will continue to implement the “D-Link Green” plan and strive to reduce the negative impact that products may have on the environment at each stage of the life cycle from the four aspects, namely product design, functionality, materials, and packaging, in order to implement the corporate social responsibility. After D-Link announced the M30 AX3000 Wi-Fi 6 Dual-Frequency Wireless Routers, the first product remade from PCR plastic in June 2023, immediate attention and expectations in the European market were gained. The five new products of the series launched subsequently are also made from PCR plastic. In the future, in addition to continuing this measure, we will also evaluate the feasibility of introducing recycled metals. | Currently, D-Link has sufficient funds of its own and has no urgent and continuing financing needs. However, it will maintain its focus on green financing or low-carbon financing, maintain close contact with financial institutions that actively promote sustainable and low-carbon financing, improve the quality of its own ESG disclosure information, and maintain its qualifications in line with the green financing review standards. In order to quickly obtain the support of banks and evaluation agencies when operations require, we can undertake borrowings or issue bonds linked to sustainable development, so as to minimize the Company‘s capital costs while demonstrating the Company‘s long-term commitment to climate change and environmental sustainability. |

* For the complete list of climate-related opportunities and responses, please refer to D-Link’s 2024 Sustainability Report, pages P.115-116

Risk Management

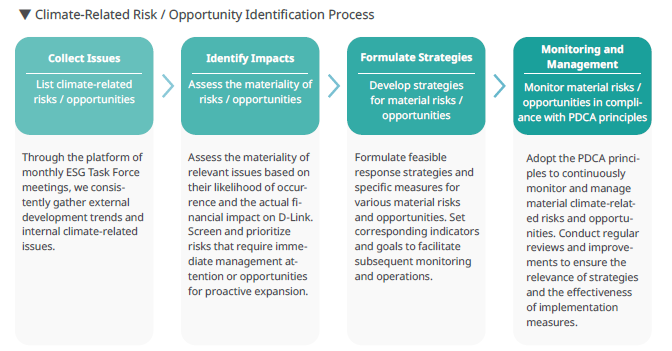

D-Link manages climate-related risks and opportunities through 4 key processes : collecting relevant issues and trends via monthly ESG Task Force meetings, regularly assessing the impact and materiality of each risk and opportunity, formulating corresponding strategies and indicators, and applying PDCA principles for annual tracking and review. This structured approach aims to achieve overall control and ensure timely responses. For the material climate risks identified, the ESG Office not only reports them upwards but also submits them to the Risk Management Task Force for evaluation regarding their potential inclusion in the Company’s overall risk management system.

Climate-related Risk/Opportunity Identification Process

Metrics and Targets

In order to achieve the 2050 net-zero emissions goal, D-Link not only sets corresponding short / medium / long-term goals for energy saving, carbon reduction, water saving and waste reduction, but also actively launches various project plans, promotes relevant measures, and implements management and effectiveness evaluation accordingly, and at the same time, the performance results are confirmed through the external verification to achieve the goal of environmental sustainability.

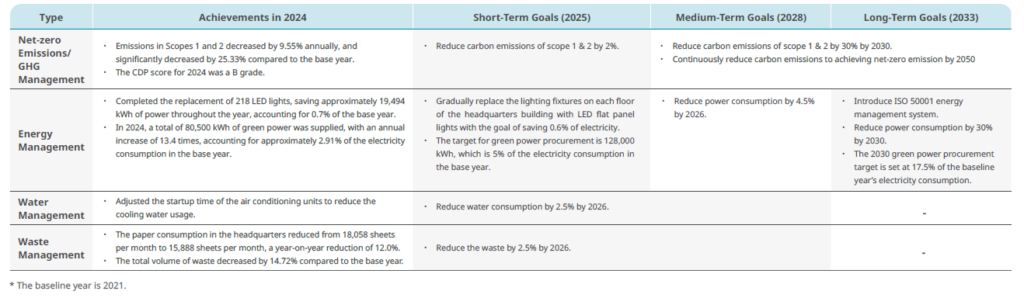

The Relevant Implementation Performance and Short, Medium and Long-term Goals Responding to Climate Change