- About D-Link

- Products and Services

- ESG

Sustainable Development

Sustainable Supply Chain

Sustainable Workplace

For Stakeholders

- Investor Relations

- News Room

- Careers

Home > ESG > Governance > Risk Management

Home > ESG > Governance > Risk Management

Risk Management

Home > ESG > Governance > Risk Management

Risk Management

Shaping D-Link’s Risk Management Culture

D-Link adopts the existing administrative structure and internal control mechanism to manage risks associated with business operations. According to the risk management policies and procedures, the Board of Directors is the highest management unit of risk management, and the Audit Committee is responsible for supervising the implementation of the group’s risk management policies. The President (CEO) serves as the convener of the risk management taskforce, and jointly plans, executes and supervises the risk-related management affairs with senior executives of the operating units to establish a good protection mechanism in the daily maintenance. Risk measurement indicators are developed for key risk categories to review risk management mechanisms regularly, and strategies, control objectives, internal control systems and procedures are established to effectively prevent and manage risk-related company operations.

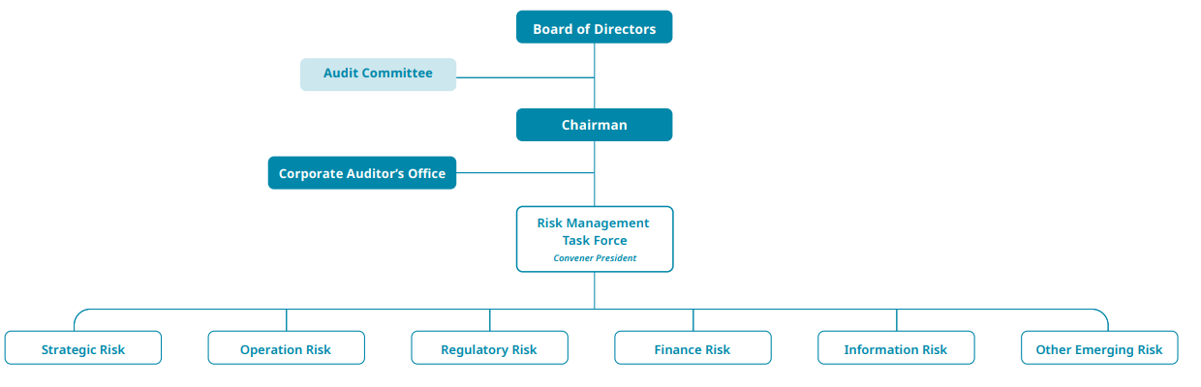

Risk Management Framework

Risk Management Framework

Board of Directors:

The Board of Directors is the highest governance for risk management, aiming to comply with the laws and regulations and enforce risk management in the company. They clearly understand the operational risks, ensure the effectiveness of risk management, and ultimately be responsible for risk management.

Audit Committee:

The audit committee is responsible for implementing the risk management issues, overall implementation, and coordination of the operation and reports to the Board of Directors at least once a year.

Risk Management Taskforce:

The President (CEO) acts as the convener and convenes risk management meetings every quarter. The duties of the Risk Management Taskforce are responsible for planning, implementing, and supervising risk management-related matters and reporting the implementation of risk management to the Audit Committee at least once a year.

Corporate Auditor’s Office:

The Corporate Auditor’s Office is responsible for internal control and internal audit. They develop an annual audit plan and conduct various audit operations based on the results of risk management every year. They assist the Audit Committee and the Board of Directors in overseeing potential risks associated with policy implementation, ensuring effective control over all risks, and regularly reporting audit results to the Audit Committee and the Board of Directors.

Operating Units:

Each operational manager is responsibility for risk management and is accountable for analyzing and monitoring the relevant risks in the subordinate units to ensure the effective implementation of the risk control mechanism.

Risk Management Procedures

Operating Status of Risk Management

- In order to comply with the requirements of the “Corporate Governance 3.0 – Sustainable Development Blueprint” and the “Risk Management Best Practice Principles for TWSE/TPEx Listed Companies” issued by the Financial Supervisory Commission, responding to the Company’s current practical risk management operation mechanism, the Company amended the “Risk Management Policies and Procedures” and such are implemented after approved with the resolution of the Board of Directors on May 10, 2023.

- To comply with “Risk Management Policies and Procedures”, the Company convene risk management meetings on a quarterly bases on March 17, June 30, September 22 and October 27, 2025, to plan, implement and supervise quarterly risk management operations, to ensure that all risks are effectively managed.

- As part of the annual review of the risk management system, the key risks and mitigation efforts are reviewed by the Board of Directors and Audit Committee in February 26 ,November 12, 2025.

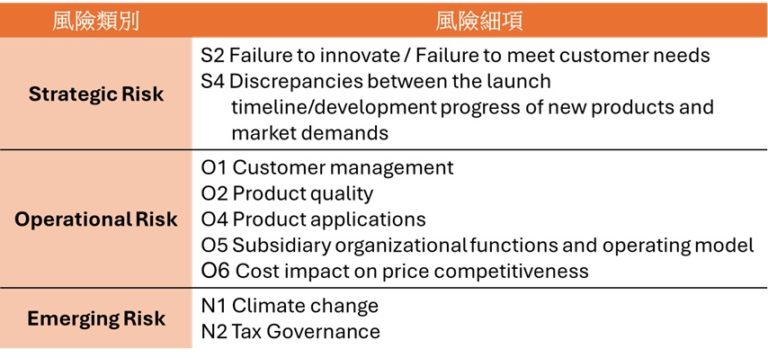

Key risks of the Company identified at the beginning of 2025

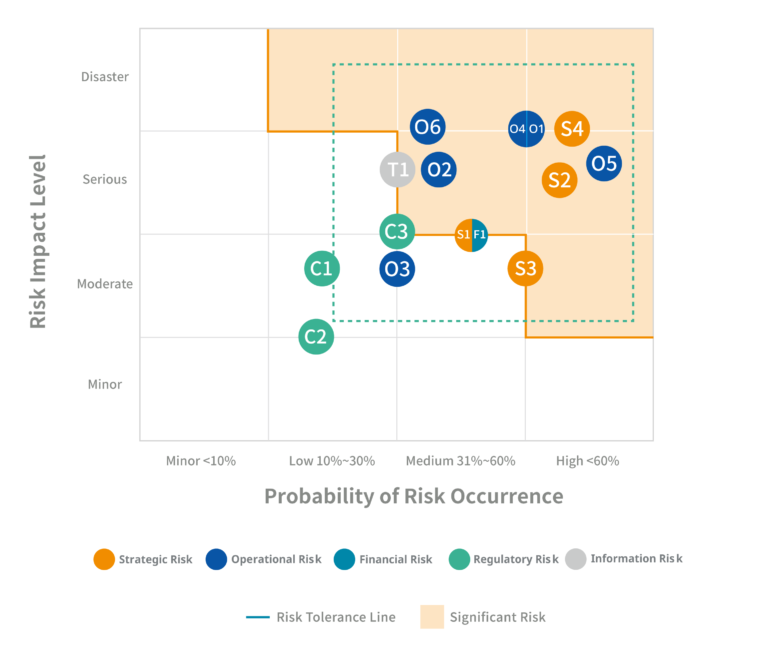

2025 Risk Assessment Matrix

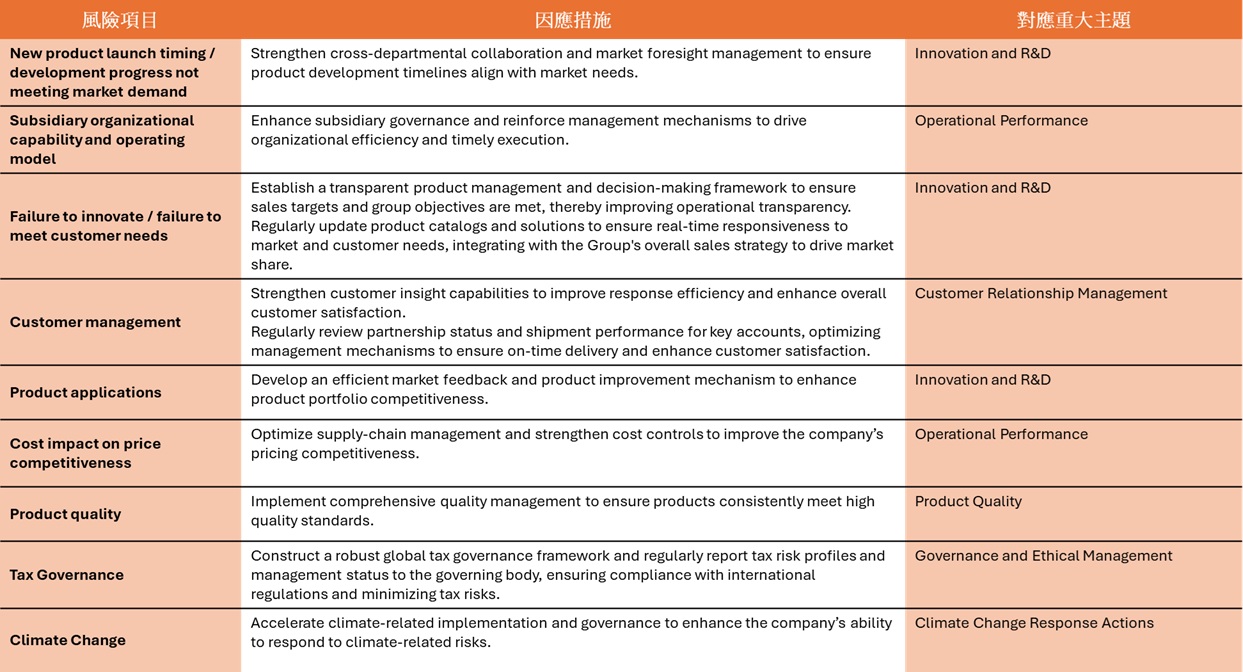

Risk Control Measures